32+ mortgage interest tax write off

It all depends on how the property is used. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

. Can A claim 100 of the deduction. Web Here is an example of what will be the scenario to some people. Meaning if your home is more than 1000000 you will not be able.

Web Mortgage interest. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must.

Web Interest paid on your mortgage is deductible. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up.

Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The short answer is.

Web Most homeowners can deduct all of their mortgage interest. The deduction only covers the first million dollars of your mortgage interest. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000. 16 2017 then its tax-deductible on mortgages. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent.

Lets say you paid 10000 in mortgage interest and are. You can write-off the interest you pay on the first 750000 of home loans on homes purchased after December 15 2017. Singles and married couples filing jointly can get mortgage interest deductions on the first 750000 of each.

Web Assume for example that A and B are joint owners of the home but A pays 100 of the property taxes and mortgage interest. Web First know that theres a cap.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

When Is Mortgage Interest Tax Deductible

Oct 13 At Home In Berks By Christian D Malesic Mba Cae Cmp Iom Issuu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

2207 W Kammi Ave Spokane Wa 99208 Realtor Com

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Wsj Tax Guide 2019 Mortgage Interest Deduction Wsj

Bank Of America Fair Value Is 32 4 Per Share In A Bull Case Scenario Nyse Bac Seeking Alpha

Pdf C H A P T E R A Framework For Business Analysis And Valuation Using Financial Statements Anna Yang Academia Edu

Mortgage Interest Deduction How It Works In 2022 Wsj

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction How It Calculate Tax Savings

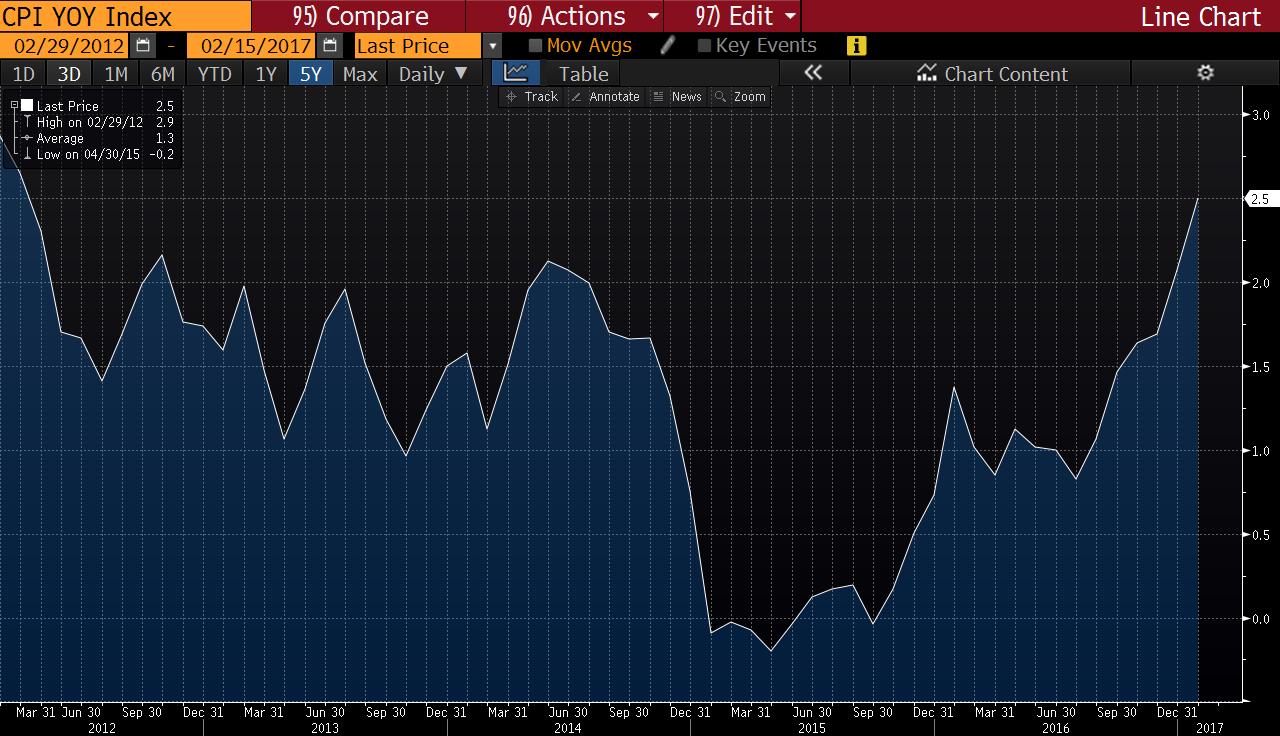

Economist S View Secular Stagnation Or Secular Boom

Mortgage Interest Deduction Bankrate

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves